6 days after we published our first AI Bubble Index, Bloomberg validated what our report detected:

“A light has been shined on the complexity of the financing, the circular deals, the debt issues. OpenAI’s connections now look more like an anchor.”

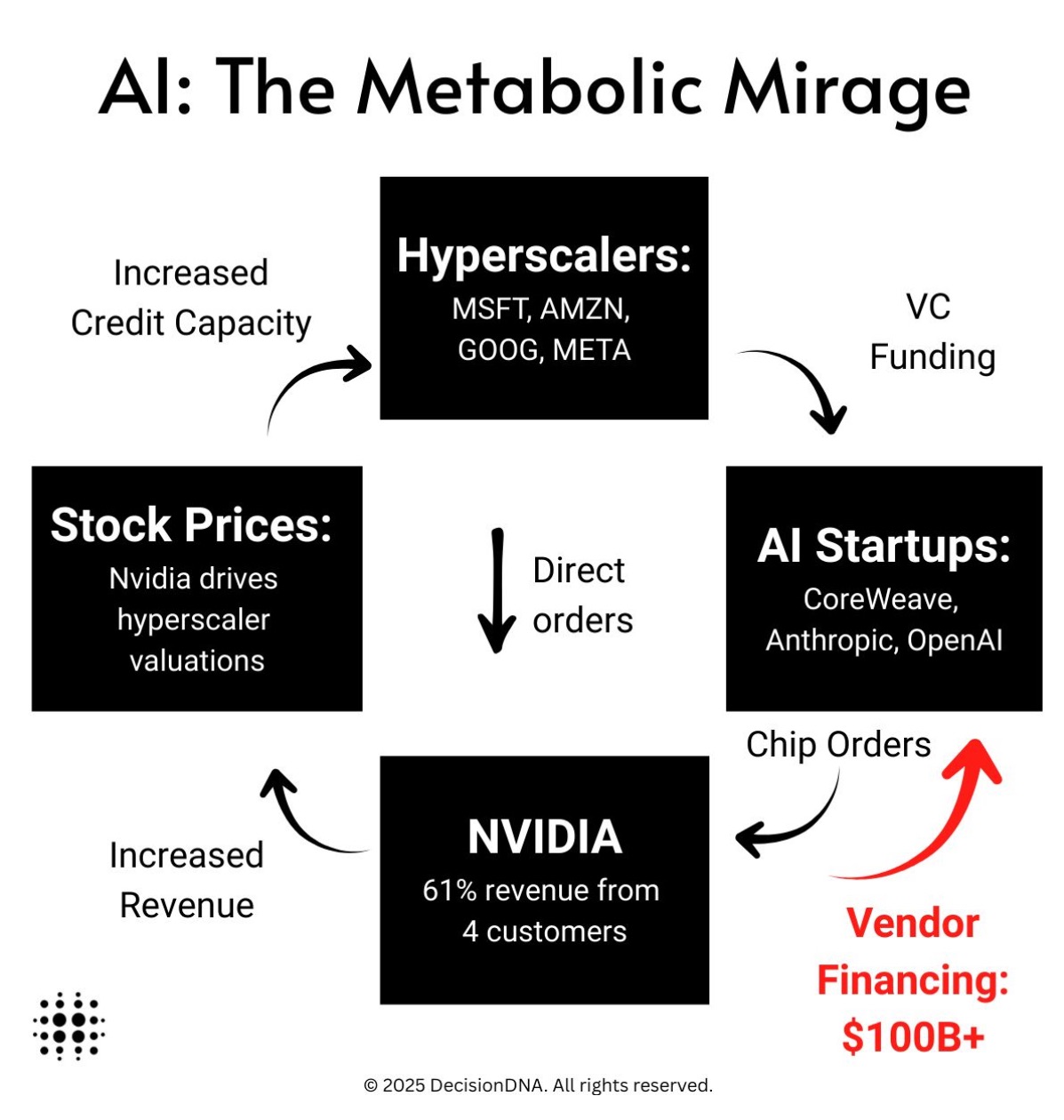

That is exactly what we described as The Metabolic Mirage (image below). Every business decision makes sense in isolation:

- Nvidia ships GPUs

- Hyperscalers deploy billions to stay competitive

- They fund AI startups, who buy Nvidia chips with vendor financing

- Nvidia’s numbers look great and all players’ equities appreciate

Asset managers surveyed by Fortune magazine just confirmed this: “You can’t call it a bubble when you’re seeing tech companies deliver a massive earnings beat.”

Well, until 1 link breaks.

Since we published a week ago, the structural stress we measured in company financials has become visible in credit markets:

- Oracle Credit Default Swap spreads: highest since the 2009 financial crisis

- Banks: using insurance to hedge AI loan losses

- OpenAI’s revenue to commitment gap: $207B (!)

We normally analyze individual companies and business units for investors and leadership teams to establish whether strategic, value creation or transformation plans can metabolize into performance. We applied the same methodology and math to the AI ecosystem to verify if the massive CAPEX commitments can metabolize in ROI.

The result: a 132x Metabolic Overload score, measuring multiplicative stress across five infrastructure layers.

Capital deployment velocity is running 132 times faster than the physical infrastructure stack can absorb it.

Links to the report, sources & 7-day timeline in comments below.

DecisionDNA #AIInfrastructure #MetabolicOverload

Article link: https://www.linkedin.com/posts/boykester_decisiondna-aiinfrastructure-metabolicoverload-activity-7403700934729560064-Sh-r?